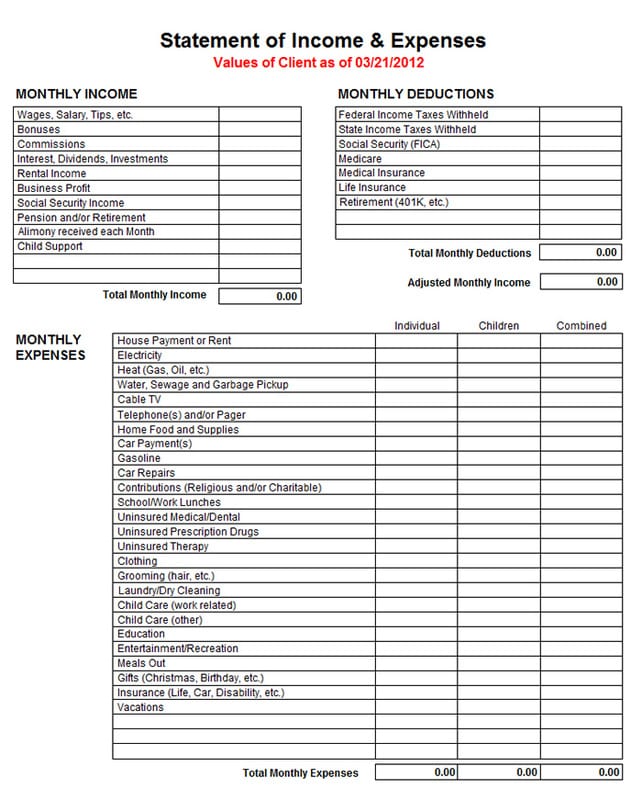

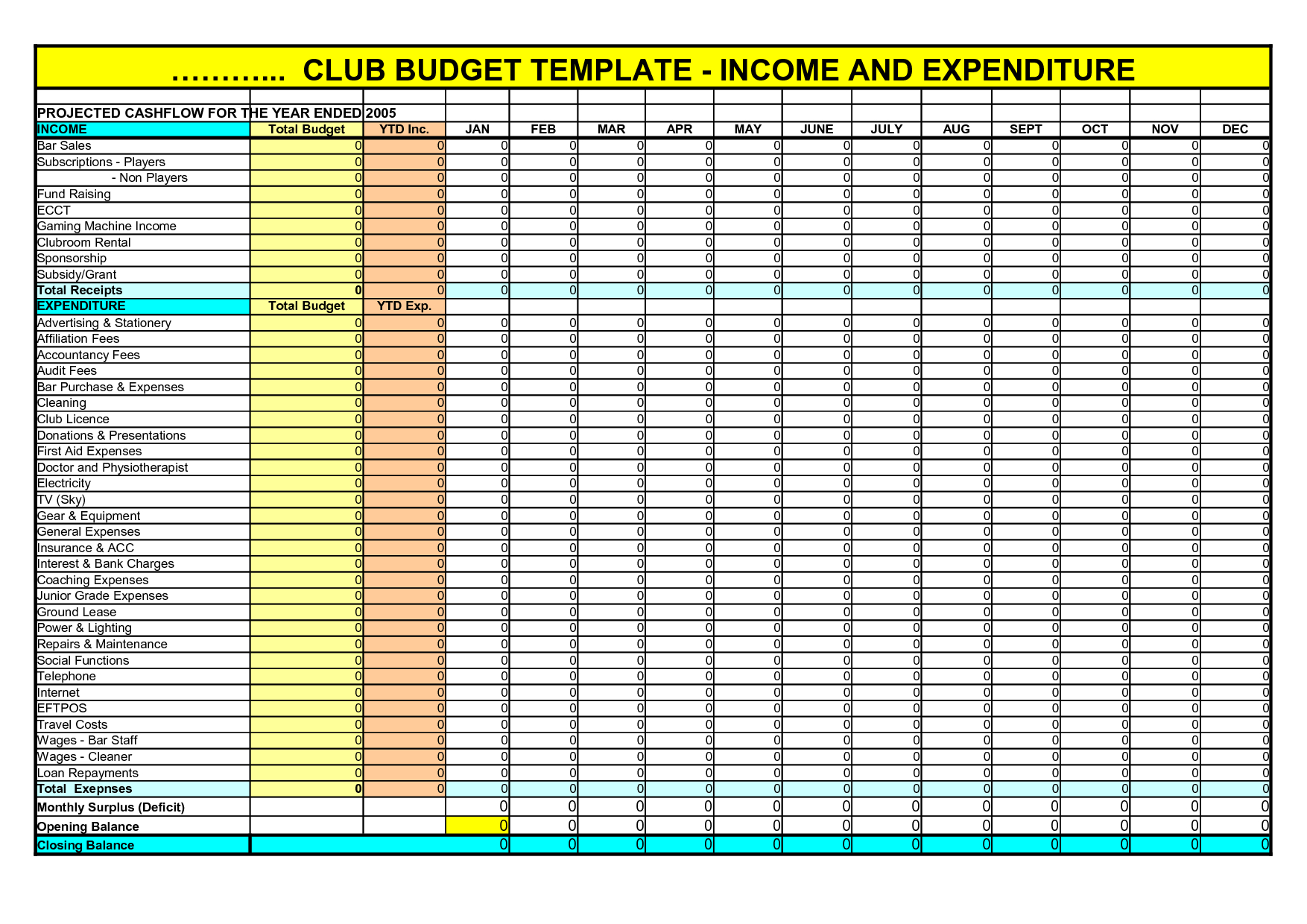

While I typically like to physically write things out, tracking my income online works better for me.īelow is a link to a google doc spreadsheet with the formatting I use to track my income, expenses, and taxes. I don’t use any fancy software to track my business finances. You need to have your income and expense ducks in a row! How I Track My Business Finances Plus, once you’re income builds you’ll also be responsible for sending in quarterly taxes. You need to take your personal situation into account to figure out what’s best for you. I see a lot of other people saving 30% of their net income. For me 25% total works based on my tax calculator. That’s an automatic 15.3% and then you factor in federal and state taxes. (12.4% Social Security and 2.9% Medicare) You need to set aside 15.3% of your self-employment income for the first $118,500 you earn in 2015. Even better, you have to pay the portion your employer used to pay on your behalf. These FICA taxes that used to be paid by your employer are now up to you. In addition to owing Federal and State Taxes you’re also on the hook for social security and Medicare. I think many people go into side hustling and self-employment blindly not realizing just how big of a chunk they’re going to owe Uncle Sam once tax time rolls around.

You need to be aware of where you stand each and every month.

Track your income and expenses so you can grow your business. You can look in one place and see exactly how each of your clients rank when it comes to income. This is also helpful when you’re comparing freelance client pay.

0 kommentar(er)

0 kommentar(er)